First of all, congratulations to all Splunk employees, VCs and shareholders! Today is a great day for your company and those of us in Big Data (see who else is who in Big data here).

Almost 12 months ago I wrote a post titled: “LinkedIn’s IPO –A Perfect Storm of Big Data,Open Source and Cloud Computing” in which I marveled at the then $9B market cap a few days after the IPO. I noted that LinkedIn used or involved 3 core technology areas: Big Data, Open Source and Cloud Computing.

Today, I was excited to see that Splunk IPOed and immediately doubled in price making it worth a cool $3B, mostly on the basis of the hype and reality of Big Data. For an interesting financial and company analysis, see Dave Kellog’s post in January about Splunk’s S1 and impending IPO. It’s a great analysis, describing Splunk’s marketing as “the Virgin America of log file analysis,” as evidenced by one of many funny tag lines that often appear on t-shirts they hand out to their users and at trade shows:

The only thing he may have missed the mark on, was that he felt the predicted $1B valuation to be rather high. Wonder what he thinks of the $3B market cap today? Irrational exuberance, high tech bubble, Instagram effect or Big Data trending?

What does Splunk provide for its $40M VC money raised, $3B market cap on $121M in revenues and a $11M loss? According to “About the company” on Splunk.com

Splunk was founded to pursue a disruptive new vision: make machine data accessible, usable and valuable to everyone. Machine data is one of the fastest growing and most pervasive segments of “big data”--generated by websites, applications, servers, networks, mobile devices and the like that organizations rely on every day. By monitoring and analyzing everything from customer clickstreams and transactions to network activity and call records–and more, Splunk turns machine data into valuable insights no matter what business you’re in. It’s what we call operational intelligence.

Splunk was dealing with what is now known as Big “machine-generated” Data since its founding in 2006 long before Hadoop was popular and data was merely large. Splunk cracked the code for helping a very influential constituent, the internal IT group of organizations who were struggling to analyze and manage the millions of logs generated by expanding infrastructure and data growth. In face many companies were dealing with such data at scale BH (Before Hadoop), but there is no doubt that Hadoop has raised the interest in Big Data and Big Data technologies to fever pitch, and Splunk’s IPO has just launched a nuclear missile into that explosive ammunition dump. Of course, I’m particularly excited about the Splunk IPO, since I work for RainStor, a Big Data database company, and we too at RainStor deal with the same Big Data and have done so BH. We also recently announced ourselves as the first database to run natively on Hadoop.

The Splunk IPO is good for everyone who’s in the Big Data space, both from a VC valuation perspective but also a general public understanding of the types of real-life Big Data challenges that our technologies are looking to solve.

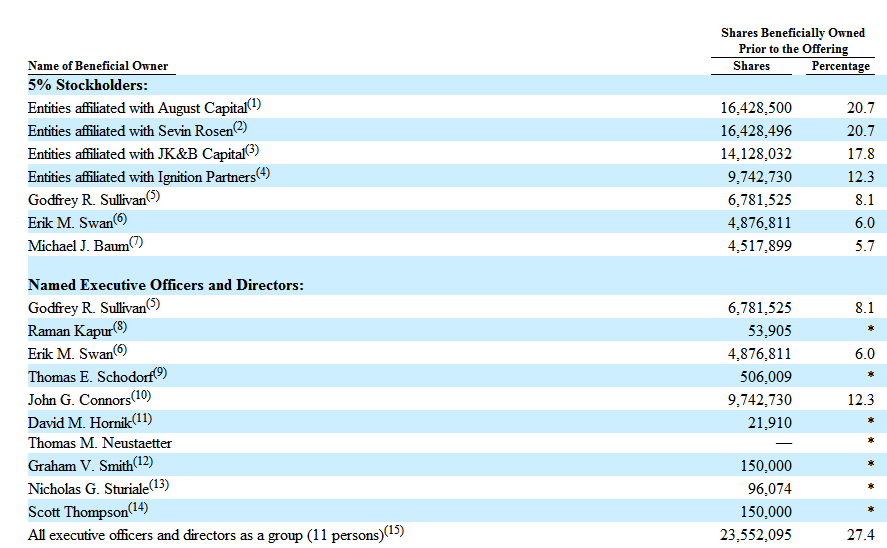

In closing to show that everything is happening at warp speed and extraordinary valuations, note that the CEO of Splunk, Godfrey Sullivan (who incidentally has 8% of the company now valued at about $250M – see table at the end of the post), was previously the CEO of Hyperion (founded originally as IMRS in 1981, 26 yrs old), when they were sold to Oracle in 2007 for $3.3B on revenues of about $1B with 2500 employees. Today Splunk (founded in 2006 – 6 yrs old) is pushing on that market valuation with just $121M in revenues and about 500 employees.

It won’t be long before more Big Data related IPOs and M&A follow, thanks and congrats again to Splunk for leading the way.